Why Choose BASE Yield Explorer?

Comprehensive Discovery

Scan across numerous protocols and assets to find hidden gems and top-performing yield strategies.

Risk-Adjusted Insights

Filter opportunities based on clear risk categories (Low, Medium, High) with detailed explanations.

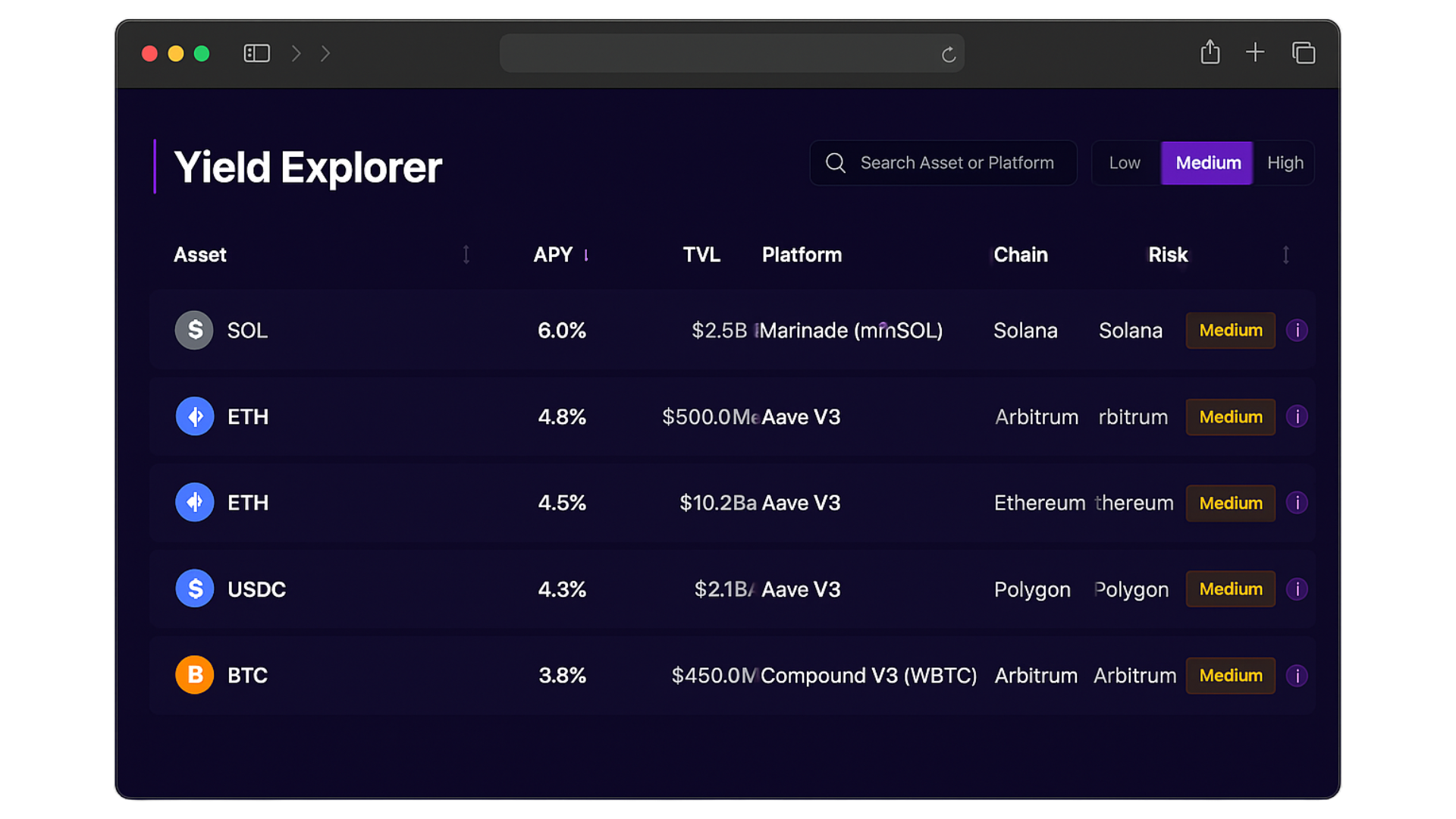

Data-Driven Comparison

Easily compare APY, TVL, platform reputation, and associated risks side-by-side.

Up-to-Date Information

We strive to keep our data current (Note: real-time data integration is complex!) to reflect market changes.

Clear Risk Breakdowns

Understand the specific risks involved with each opportunity via our detailed info modals.

BASE-First Approach

Built specifically for the BASE L2 ecosystem, providing the most comprehensive yield explorer for this fast-growing network.

How Yield Explorer Works

Data Aggregation

We gather yield data from various DeFi protocols, APIs, and on-chain sources (conceptually).

Risk Assessment

Our system (or manual curation) categorizes opportunities based on factors like smart contract audits, platform history, strategy complexity, and centralization risks.

Filtering & Sorting

You filter by your preferred risk level, search for specific assets, and sort by APY, TVL, or other metrics.

Informed Decision

Review the detailed information, including risk breakdowns, to choose the best opportunities for your portfolio.

BASE Protocols We Track

Comprehensive coverage of the most important DeFi protocols on BASE L2.

List Your Protocol

Are you a DeFi protocol looking to showcase your yield opportunities? Join Yield Explorer to reach a wider audience of yield-seeking users.

Frequently Asked Questions

How is the risk level determined?

+Risk levels (Low, Medium, High) are assigned based on a combination of factors including: smart contract audit history, protocol track record, strategy complexity, reliance on external oracles, potential for impermanent loss, and centralization risks associated with the platform or underlying asset (like wrapped tokens). This is often a qualitative assessment and should be used as a guide, not definitive financial advice.

How often is the data updated?

+We aim to update APY and TVL data frequently (e.g., daily or multiple times a day via APIs where available). However, real-time accuracy across all platforms is challenging. Always double-check the rates directly on the platform before depositing funds. Risk descriptions are updated periodically based on new developments or audits.

Is Yield Explorer free to use?

+Currently, Yield Explorer is free to use. We may introduce premium features or subscription tiers in the future to support ongoing development and data aggregation costs. Our goal is to always provide significant value in the free tier.

Does Yield Explorer custody my funds?

+No. Yield Explorer is purely an informational tool. We do not connect to your wallet (unless a future portfolio feature is added, which would be opt-in and use secure standards) and never have access to your private keys or funds. We provide links and information, but you interact directly with the DeFi protocols themselves at your own risk.

Stay Ahead on BASE

Subscribe to our newsletter for the latest BASE L2 yield opportunities, market insights, and platform updates.

Yield Explorer

Yield Explorer